The recent surge in cargo prices can be attributed to several key factors, primarily driven by geopolitical tensions, logistical challenges, and market dynamics. Here are the main points from the sources provided:

Geopolitical Tensions and Security Threats

- Red Sea Crisis:

- Houthi Attacks: Yemen’s Houthi militants have been attacking commercial vessels in the Red Sea, a critical trade route, leading to significant disruptions. These attacks have caused many shipping companies to reroute their vessels around the Cape of Good Hope, adding significant travel time and costs.

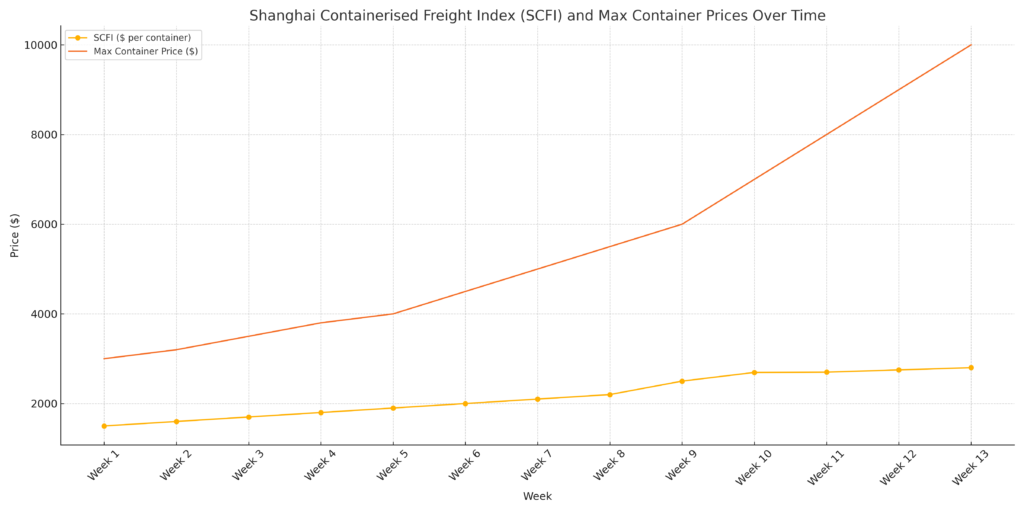

- Increased Costs: The rerouting has led to a dramatic increase in shipping costs. For instance, the Shanghai Containerised Freight Index (SCFI) saw an 80% increase in a single week, reaching $2,694 per container. Other reports indicate container prices reaching as high as $10,000.

Logistical Challenges

- Port Congestion and Container Shortages:

- Extended Transit Times: The longer routes required to avoid the Red Sea have increased travel distances for cargo and tankers by up to 53%, causing a rise in CO2 emissions due to additional fuel burned. This has also led to severe port congestion and a notable shortage of available containers.

- Impact on Supply Chains: The delays and increased costs are causing significant disruptions in supply chains, particularly for goods imported from Asia to Europe and North America. This has led to higher prices and potential shortages of goods.

Market Dynamics

- Increased Demand and Early Peak Season:

- Surge in Electric Vehicle (EV) Shipments: In anticipation of new tariffs imposed by Brazil and Mexico on Chinese-made electric vehicles, manufacturers have preemptively shipped substantial volumes to these markets, monopolizing much of the available shipping capacity.

- Early Peak Season: The looming U.S. election has stirred fears of future tariffs on Chinese goods, prompting a rush by Chinese exporters to ship goods to alternative markets like South America, further straining available resources.

Economic Implications

- Inflationary Pressures:

- Higher Shipping Costs: The increased shipping costs are expected to contribute to inflation, affecting the prices of goods such as electronics, furniture, and oil. This comes at a time when inflation was beginning to stabilize.

- Insurance and Wages: The designation of the Red Sea as a warlike area has led to higher insurance premiums and increased wages for mariners, further driving up costs for shipping companies.

Broader Economic Impact

- Global Trade Disruptions:

- Supply Chain Delays: Businesses across various sectors are facing delays in receiving raw materials and finished goods, disrupting production schedules and market availability.

- Competitive Disadvantages: Companies unable to absorb or offset the higher shipping costs are finding themselves at a competitive disadvantage, potentially losing market share to those with better-managed supply chains.

In summary, the recent increase in cargo prices is a complex issue driven by geopolitical conflicts, logistical challenges, and market dynamics. The ongoing disruptions in the Red Sea, combined with container shortages and increased demand, are likely to continue impacting global trade and inflation in the near term.

Projecting the End of the Crisis

Based on an analysis of the provided sources, here is a detailed projection of when this crisis may come to an end:

Geopolitical and Security Factors

- Red Sea Crisis:

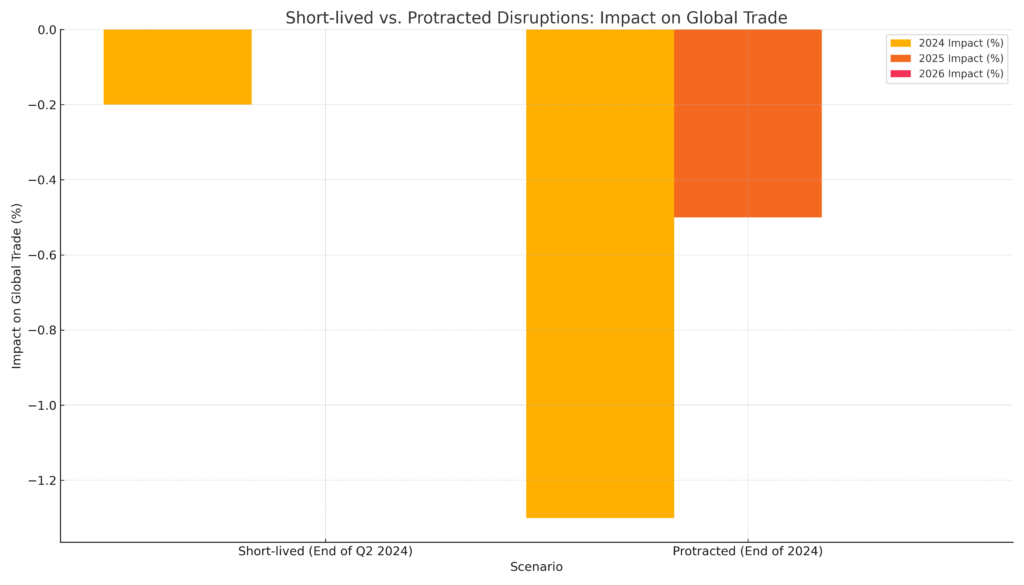

- Short-lived vs. Protracted Disruptions: According to a model-based analysis, if the disruptions in the Red Sea are short-lived and resolve by the end of Q2 2024, the impact on global trade will be minimal, with a decrease of only 0.2 percentage points in 2024 and no effects in 2025-26. However, if the disruptions are protracted and extend to the end of 2024, global trade could decrease by 1.3 percentage points in 2024 and by 0.5 percentage points in 2025.

- Insurance and Security Costs: The ongoing attacks by Houthi rebels have led to increased insurance premiums and security costs, which are likely to keep freight rates elevated until the security situation stabilizes.

- Strait of Hormuz and Other Choke Points:

- Potential Escalation: The situation in the Strait of Hormuz remains tense, and any further escalation could significantly impact oil and global trade, potentially prolonging high freight rates.

Logistical Adjustments

Rerouting and Capacity:

- Rerouting Around Africa: Many shipping companies are currently rerouting vessels around the Cape of Good Hope, which adds significant travel time and costs. This rerouting is expected to continue until the security situation in the Red Sea improves.

- Container Availability: The rerouting has exacerbated container shortages, but the global supply of container ships remains high, which could help stabilize rates once the disruptions are resolved.

Port Congestion and Infrastructure:

- Panama Canal and Other Routes: The Panama Canal is also experiencing disruptions due to drought, which is expected to improve by 2025. This, combined with the Red Sea crisis, has led to increased congestion and delays.

Market Dynamics

Demand and Supply:

- Seasonal and Cyclical Factors: The demand for shipping typically fluctuates with seasonal trends. The current high rates are partly due to increased demand and logistical challenges. As global demand stabilizes and new container ships enter service, rates are expected to decrease.

- Inventory Levels: High inventory levels in firms are currently cushioning the impact of higher freight rates. As these inventories are depleted, the pressure on shipping rates may ease.

Economic Conditions:

- Inflation and Consumer Prices: The increased shipping costs are contributing to inflation, particularly in the prices of imported goods. This inflationary pressure is expected to persist until shipping rates normalize.

Projections

Short-term (2024):

- Continued High Rates: Shipping rates are likely to remain elevated through at least the first half of 2024, especially if the Red Sea disruptions continue. The impact on global trade and inflation will be significant but manageable if the disruptions are resolved by mid-2024.

Medium-term (2025-2026):

- Normalization: If the geopolitical situation stabilizes and logistical adjustments are made, shipping rates could begin to normalize by the end of 2024 or early 2025. The entry of new container ships and improved port infrastructure will also contribute to this normalization.

Long-term:

- Sustainable Solutions: The shipping industry is likely to adapt to the new geopolitical realities by diversifying routes and investing in more resilient supply chains. This could lead to more stable and predictable shipping rates in the long term.

In summary, while the exact timeline for the resolution of the current shipping disruptions is uncertain, it is likely that cargo prices will remain elevated through 2024, with potential normalization beginning in 2025, provided that geopolitical tensions ease and logistical challenges are addressed.

For innovative solutions in custom-built manufacturing and advanced powder metallurgy, visit Starpath Rail and our advanced solutions page. Feel free to contact us for more details.